How Do I Buy the Best Silver Coins

Intro

One of the best and most affordable ways to save money and build wealth is with Silver. The price of silver is on the rise but the price is still one of the best investments you could make. So how do I buy the best Silver Coins you might ask? >>>QuickSilver just might be for you.

How Do I Buy the Best Silver Coins: A Comprehensive Guide to Investing in Silver Collectibles

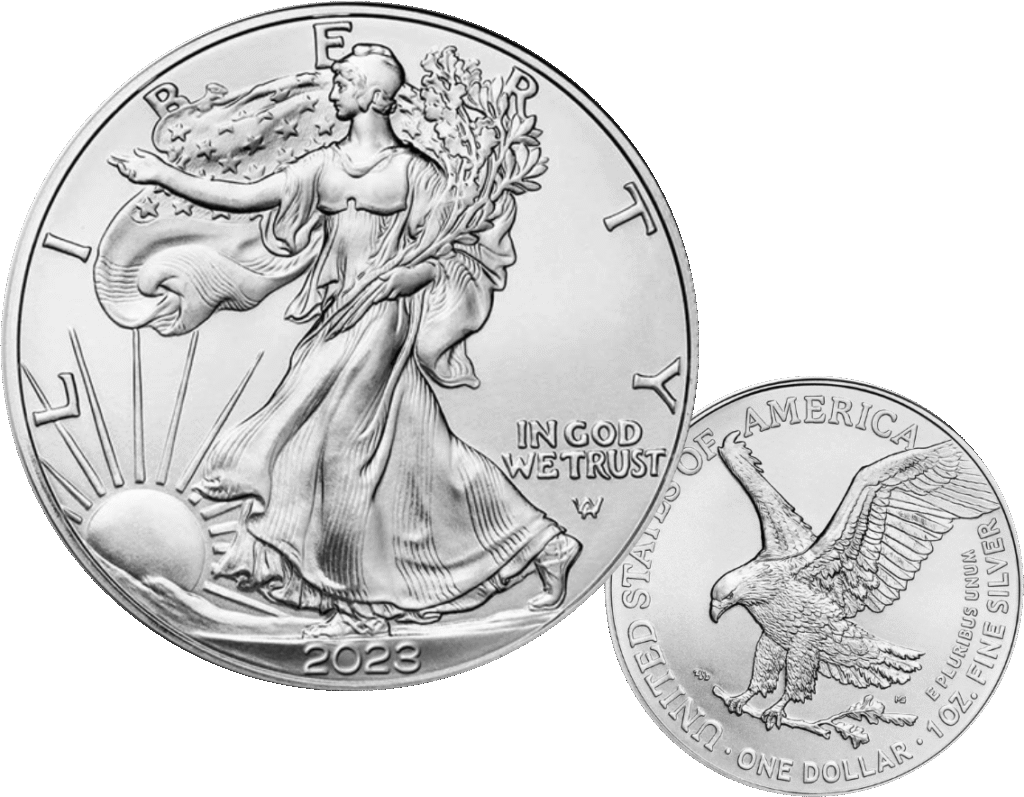

Investing in silver coins has become more popular than ever. They’re easy to buy, hold value, and add variety to your investment portfolio. Silver coins are a smart way to diversify and protect your money from inflation. But buying the right coins isn’t as simple as it seems. Making smart choices can boost your chances of a profitable collection or investment. This guide will show you how to find and buy the best silver coins, step by step.

Understanding Silver Coins as an Investment: Why They Matter

Market Significance of Silver Coins

Silver coins have a long history. People used them as currency ages ago. Today, they’re valued for their beauty and value. Silver prices often move with economic trends, making coins a good hedge during tough times. They’re a part of any solid precious metals portfolio. Collectors also see silver coins as art and history trapped in metal.

Benefits of Investing in Silver Coins

Silver coins are easy to sell because they’re portable and widely accepted. Their beauty makes them attractive to collectors. They also act as a safety net when the economy looks shaky. During periods of inflation, silver’s value tends to rise. Plus, owning tangible coins gives peace of mind it’s not just digital money.

Risks and Considerations

Market prices change fast, so prices can go down as well as up. Counterfeit coins are a real danger — always check authenticity. Storage costs can add up, especially if you own many coins. Proper security measures are essential to protect your assets.

Key Factors to Consider When Buying Silver Coins

Purity and Sterling Content

Look for coins with at least 0.999 purity, known as fine silver. Some coins might be less pure, lowering their value. Always check the silver content on the coin or its label. Genuine silver coins will indicate their purity.

Coin Rarity and Minting Year

Limited runs and low mintage numbers make coins more valuable. Coins from special years or with unique designs can increase in worth over time. Rarity is a big factor in how much your coins might appreciate.

Condition and Grading Standards

Coins are graded on how good they look. Grading services like PCGS or NGC give each coin a score from poor to perfect. A better grade means a higher resale value. Never buy coins in poor or damaged condition if you want to maximize value.

Authenticity and Certification

Always look for certified coins. Certificates of authenticity prove a coin is genuine. Fake coins can look real but are worth nothing. Buy from trusted sellers who provide verified certification. Be cautious of scams and counterfeit products.

Top Sources and Marketplaces for Buying Silver Coins

Reputable Coin Dealers and Bullion Sources

Choose dealers with good reputations. Look for certifications and positive reviews. Trusted online sources include APMEX, JM Bullion, and local coin shops. These vendors offer high-quality coins with clear authenticity.

Online Marketplaces and Auction Platforms

Websites like eBay and Heritage Auctions let you buy from individual sellers or collectors. Always check seller ratings and reviews before bidding. Use secure payment methods and ask for detailed photos. Bidding strategically can save you money.

Coin Shows and Collectors Expos

In-person events let you see coins firsthand. This allows for better inspection and negotiation. You might find rare coins you couldn’t see online. Search for reputable coin shows in your area for the best deals.

Tips for Identifying and Selecting the Best Silver Coins

Conducting Due Diligence

Research a coin’s history, current market value, and mintage. Consult resources like the Red Book or Numismatic Guaranty Corporation (NGC). Know what makes a coin special and worth more.

Budgeting and Price Comparisons

Set a clear budget for your investment. Compare premiums over current silver spot prices across vendors. Avoid paying too much above the market average. Remember, a lower premium can mean better profits later.

Timing the Purchase

Follow silver price trends. Watch for dips and market lows to get better deals. Buying when prices are down can increase your chances of profit. Stay updated with financial news related to commodities.

Storage and Security

Store your coins securely in a safe or a lockbox. Consider insurance for larger collections. Proper storage prevents theft, damage, and loss. Digital records of certificates and purchase receipts help in future sales.

Expert Insights and Practical Strategies

Experts say maintaining a well-rounded collection is best. “Buy coins that hold or increase their value over time,” advises a seasoned collector. Diversifying your coins and not overpaying are key strategies. Successful investors focus on quality, rarity, and market timing.

Case studies show some investors doubled their money by buying coins at the right time. Patience and research pay off. Always keep learning and pay attention to market trends.

Conclusion: Making Informed Silver Coin Purchases

Buying silver coins the right way starts with understanding what makes a coin valuable — authenticity, rarity, and condition. Never skip your research or buy blindly. Use trusted sources and compare prices carefully. Keep learning from experts and stay aware of market changes.

Remember, the best silver coins are not just about today’s price but their potential for growth and beauty over time. Start small, stay patient, and build your collection with care. Your smart choices now can lead to a valuable, rewarding silver investment tomorrow.