Year of the Dragon Pure Silver Coin Sale

Good Day my fine Silver loving friends. Well I have a side business here at Advertise Free on the Internet. Not only do I sell advertising and give away free advertising I also sell silver. I know it’s an odd mix but hey, everyone should have a little silver to flip through their fingers. Did you know that the powers that be just said it is quite possible Silver is entering a bull phase. Of course they all say that. For you stackers and Dragon lovers the Chinese Lunar cycle is here! It is the Year of the Dragon.

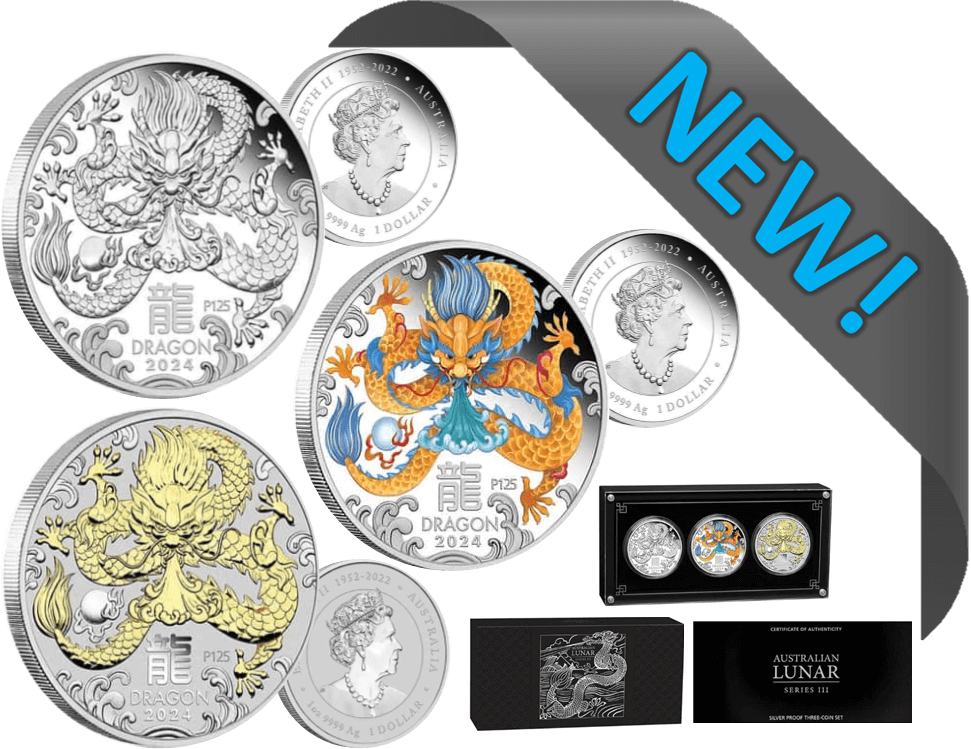

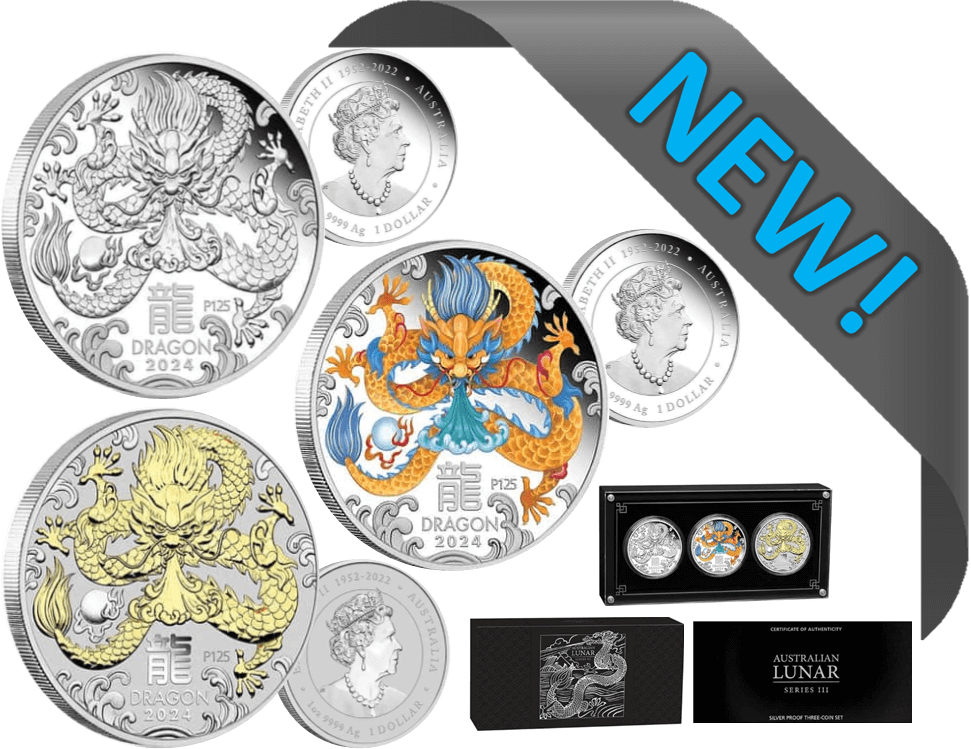

Why choose the 2024 Perth Mint 3oz (Each Coin is 1oz) Silver Lunar Dragon 3-Coin Set?

This captivating 3-Coin Dragon Set celebrates the Year of the Dragon, the next animal in the revered Chinese zodiac, embodying qualities of ambition, success, and charisma. The dragon, a symbol of wisdom and benevolence, holds a special place in Chinese culture, commanding respect and admiration for thousands of years.

Each coin is 1 troy ounce and offers a unique finish: one proof, one colorized, and one gilded, allowing you to enjoy the dragon’s magnificence from various perspectives.

This set comes in a themed box and is accompanied by a Certificate of Authenticity, enhancing its collectible value. These coins are a must-have for collectors and investors alike!

Year of the Dragon Pure Silver Coin Sale

Intricate Design:

The Reverse: Each coin portrays a powerful dragon with water cascading from its mouth, stylized waves, and a flaming pearl, symbolizing wisdom and prosperity. The design includes the Chinese character for ‘dragon’, the inscription ‘DRAGON 2024’, and a ‘P125’ mintmark signifying The Perth Mint’s 125th anniversary.

The Obverse: Each coin showcases the Jody Clark Memorial portrait of Her Majesty Queen Elizabeth II, supplemented with the dates of her reign ‘1952-2022’, weight, fineness, and the monetary denomination.

Don’t miss out, order the 2024 Perth Mint Silver Lunar Dragon 3-Coin Set for your collection today!

The coming Silver Bull

Rising inflation pressures have taken their toll on the gold market. While a lot has been thrown at the precious metal, it continues to hold critical support, at least for now, according to some analysts.

Although gold is ending its second week in negative territory, it is entering the weekend well off its lows after holding critical support at $2,000 an ounce. April gold futures last traded at $2,025.60 an ounce, down 0.64% from last Friday.

Year of the Dragon Pure Silver Coin Sale

Analysts note that gold has struggled as hotter-than-expected consumer and producer prices force investors to push back the start of the Federal Reserve’s easing cycle. Markets see only a 10% chance of a March rate cut; at the same time, the CME FedWatch Tool shows markets see only a 33% chance of a move in May. However, there are still solid expectations that the U.S. central bank could start easing interest rates in June.

Ole Hansen, head of commodity strategy at Saxo Bank, said that although gold could see further selling pressure in the near term, he remains bullish in the long term.

“We have highlighted on several occasions in recent months that both [gold and silver] are likely to remain stuck until we get a better understanding about the delivery of future U.S. rate cuts. Until the first cut is delivered, the market may at times run ahead of itself, in the process building up rate cut expectations to levels that leave prices vulnerable to a correction,” he said.

However, Hansen added that despite the risks of lower prices, robust physical demand in Asia should continue to provide support for gold until investors come in to drive prices higher.

Year of the Dragon Pure Silver Coin Sale

“Gold will likely struggle in the short term as rate cut expectations are being dialed back. But overall, I look forward to seeing how Chinese investors respond to slightly lower prices next week. I believe the physical demand from central banks and retail investors, not least in China, will continue to provide a soft floor under the market,” he added.

Barbara Lambrecht, commodity analyst at Commerzbank, said that she is not expecting to see much movement in gold in the near term as the market remains caught in a tug-of-war between investors looking for the Fed to cut rates and others expecting higher for longer.

“As the market is already very cautious with regard to key interest rates, the potential for further corrections is likely to be rather small. After all, key interest rate cuts are still expected this year,” she said.

Markets will be closed on Monday in recognition of Presidents’ Day. With markets balancing on a knife’s edge, analysts have said that investors will be paying close attention to the minutes of the Federal Reserve’s January monetary policy meeting. Gold could be sensitive to any comments regarding the timing of the central bank’s first rate cut.

Silver is the metal to watch

Julia Cordova, Founder of Cordova Trades and author of the weekly newsletter The Money Maker, said she sees more potential in silver.

“Silver looks to have been basing,” she said. “Silver will dramatically outperform gold to the upside next week.”

Michele Schneider, director of trading education and research at Market Gauge, said she is also paying more attention to silver and is completely neutral on gold.

“I am pretty much ignoring gold until prices fall to $1,920 or break above $2,100 an ounce,” she said.

Schneider said that silver, because of its robust industrial demand, is in a perfect position to benefit from rising inflation.

“We’re heading into an inflation that the Fed is not necessarily ready for or possibly able to control without killing gold,” she said. Nobody’s going to fly to silver as a safety flight unless they’re worried about inflation. Right now, we just might need to be concerned about inflation.”

The bullish calls on silver come as prices have managed to hold critical support at $22 an ounce and are ending the week testing initial resistance at $23.50 an ounce. The silver price is ending the week up 7% from its lows.

Opinion

There’s no denying inflation is real and it’s here to stay. The Fed would like no better than inflation to be 3 to 4 % for the next ten years to pay off that huge debt it has accumulated. No way to get out of this mess except inflate your way out. One, if not the best hedge against this going forward is going to be Silver.